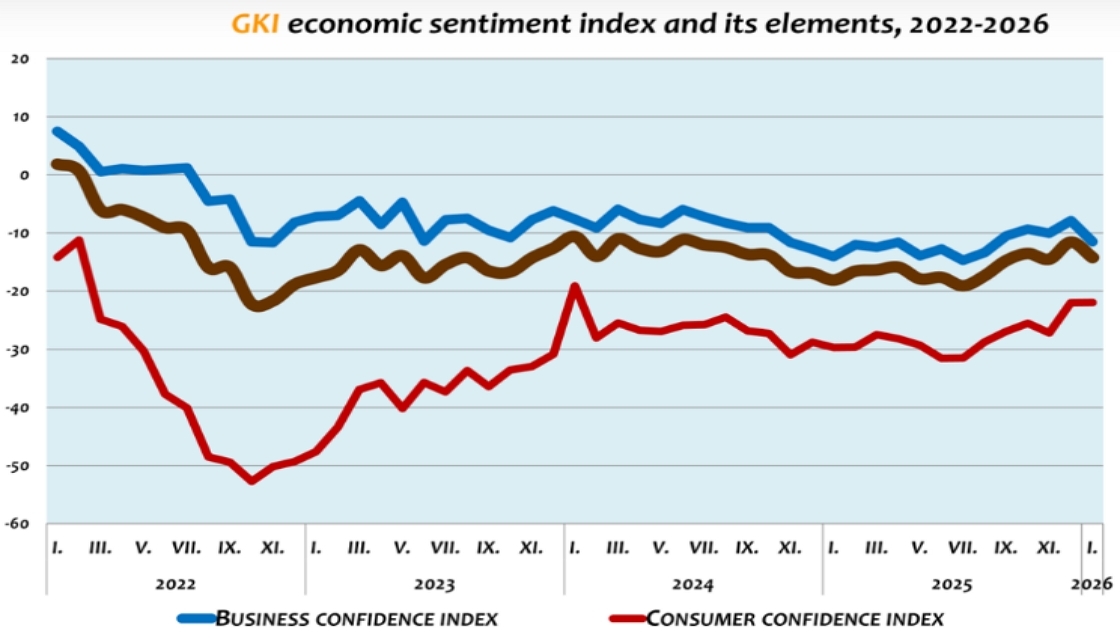

According to a survey by GKI Economic Research Co., conducted with EU support, consumer outlooks in January remained unchanged compared with December, while those of companies deteriorated slightly. The summary indicator of expectations, the GKI Business Climate Index, fell by almost three points. Firms’ willingness to hire remained unchanged, and their overall expectations for the development of selling prices edged up slightly on a monthly basis. In the first month of the year, respondent companies judged the predictability of the business environment to have improved noticeably.

GKI’s business confidence index declined by nearly four points in January compared with the previous month, effectively returning to its level of last November. The industrial confidence index dropped sharply, by almost five points, while both the retail and services indices fell by three points each. By contrast, the construction indicator rose by three points, albeit from a relatively low base. Looking ahead, construction remains the least optimistic sector, while business services are the most upbeat.

The overall employment indicator, which reflects companies’ staffing expectations, remained unchanged in January compared with December. Over the next three months, 9% of firms plan to expand their workforce, while 12% expect to reduce it. In industry and business services, those intending to hire outnumber those planning layoffs. By contrast, in construction, the majority of firms anticipate staff reductions.

Perceptions of the predictability of the business environment improved markedly in January compared with the previous survey. The most pronounced gains were seen in the services sector, though industrial firms also found the environment considerably more predictable than in December.

The price indicator, which reflects firms’ expectations for their selling prices over the next three months, had been creeping up gradually through the autumn and winter. By January, it reached a ten-month high. Over the coming quarter, 35% of companies plan to raise prices, while 8% intend to cut them, compared with 29% and 9%, respectively, in December.

In December, GKI’s consumer confidence index rose to a two-year high and then remained unchanged in January. In the current month, households assessed both their financial situation over the past 12 months and their prospects for the next year as slightly improved compared with the previous survey. By contrast, they viewed the country’s economic outlook for the next 12 months as slightly deteriorating, and their assessment of the money available for major purchases also edged lower.

Leave a Reply Cancel reply

Top 5 Articles

Shaping a Generation of Creative and Resilient… September 10, 2025

Shaping a Generation of Creative and Resilient… September 10, 2025  New Page in the History of Budapest Airport October 8, 2025

New Page in the History of Budapest Airport October 8, 2025  Duna House Profit Climbs Nearly 70% in Q3 November 24, 2025

Duna House Profit Climbs Nearly 70% in Q3 November 24, 2025  Representing France in Familiar Territory October 6, 2025

Representing France in Familiar Territory October 6, 2025  Richter Earnings Slip as Financial Loss Weighs November 6, 2025

Richter Earnings Slip as Financial Loss Weighs November 6, 2025

No comment yet. Be the first!